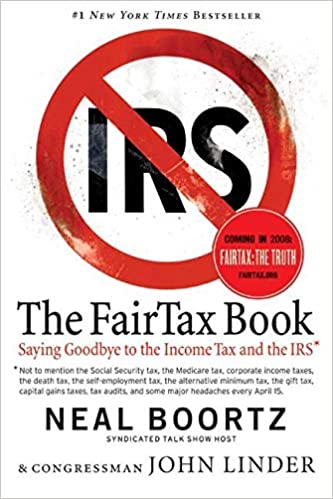

Neal Boortz – The Fair Tax Book Audiobook (Biding Farewell to the Earnings Tax as well as the INTERNAL REVENUE SERVICE)

Something that couple of have actually talked about when it pertained to the “different other” money that will certainly be included in the financial environment (past the pusher, lady of the roads, as well as likewise below ground financial circumstances), are those that are NOT made use of. The Fair Tax Book Audiobook Free. Those that trade on the safeties market pay resources gains tax commitments, nevertheless they currently pay definitely nothing to Social Safety and security or Medicare. Identical picks real estate buyers/sellers. The FairTax will definitely produce significant profits (as well as by numerous accounts the 23% comprehensive tax responsibility is above what the actual tax would definitely need to be to make the federal government tax responsibility revenues revenue neutral), as well as likewise the meaningless management fees (over $500 Billion/year) that we invest to simply be licensed with the present profits tax responsibility would definitely be cleansed away.

Another element of critics are for the “transitionary” duration. Those that hold Roth IRAs are mosting likely to stand as well as likewise whine that those with typical Individual retirement accounts that are expected to be exhausted when cash is obtained are obtaining an unreasonable benefit since the Roth variables have really currently paid profits tax commitments on their cash where as the conventional Person Retired life Account people have not. To those, I specify this: do not quit this from going through which most of us will certainly profit for to spite those that profit a bit additional. If you desire to whine, inform your congressmen to give you back numerous of that rate of interest- bearing account money WHEN THE FAIRTAX HAS ACTUALLY REALLY BEEN DEVELOPED. Unfortunately, I think the death of the Fairtax stays in the understanding that payments made in the unreasonable system will certainly not be made up for in the change to a Fairtax. Once more, although everybody acquires there will certainly be those that bog the procedure down since someone is acquiring above they are … a ground that is productive for politicians to manipulate to place the kabash on the Fairtax.

An additional point: DO NOT LET THE GOVERNMENT INVESTING ISSUE HINDER OF IMPLEMENTING THIS. I was focusing on a radio program where a customer contacted us to promote the Fairtax in addition to the host promptly declared “well, I presume the larger worry stays in federal government investing.” Individuals, the element individuals apathetic worrying federal government investing results from the truth that they ignore just how much of their very own money mosts likely to the federal government. We can strike costs once it ends up being clear to everyone just how much money they are using the federal government. MAKE THE FAIRTAX HAPPEN NOW.

To me this is such a breeze it’s dispiriting to presume that there are numerous doubters. For several years I have actually listened to individuals state that the federal government will certainly spend for this or that. Awaken. We are the federal government’s wallets. When companies pay much more tax obligations, that fundamental fee them to the general public … us. The federal government is collecting this cash in numerous way ins which the general public has actually dropped track. We pay tax obligations on profits, expenses, preserving as well as passing away.

Some individuals think that they are obtaining ‘federal government cash’ when they obtain their tax ‘repayment’ back. They forget that the cash was removed from their income each pay period.

There are numerous points to take into account concerning the present tiring system. A minimum of check out the book before composing your mind based upon perspectives by individuals that have plainly not have a look at the book or do not comprehend the concepts. I have yet to assess a counterclaim that thinks about the huge photo. Certain there can, as well as perhaps will, be problems in the change; nevertheless, we can not continue along the present course of taxes. The Fair Tax responsibility Book clarifies this advanced approach as well as does something a great deal extra wonderful. It makes it enjoyable. Absolutely if you remain in search of a socialist heaven, the Fair Tax responsibility is not what you look for. It will certainly most certainly drop brief in Karl Marx’s objectives of punishing success in addition to inhibiting individual financial savings. Ask on your own one concern: The quantity of times have you made foolish choices given that you were considering tax effects? Have you mistimed an opportunity or stayed clear of one completely since you remained in concern of tax responsibility fines or maintaining popular of the Irs? Neal Boortz -The Fair Tax Book Audio Book Online In The Fair Tax Magazine Neal Boortz in addition to John Linder reveal you why it does not require to be in this way. They make clear in common as well as typically funny language why this approach will certainly permit the federal government to be moneyed currently degrees with definitely NO impact in the red as well as likewise produce a tax environment where people do not require to fear their federal government. Review this book as well as you will certainly understand likewise.